Student Loan Refinancing vs Consolidation

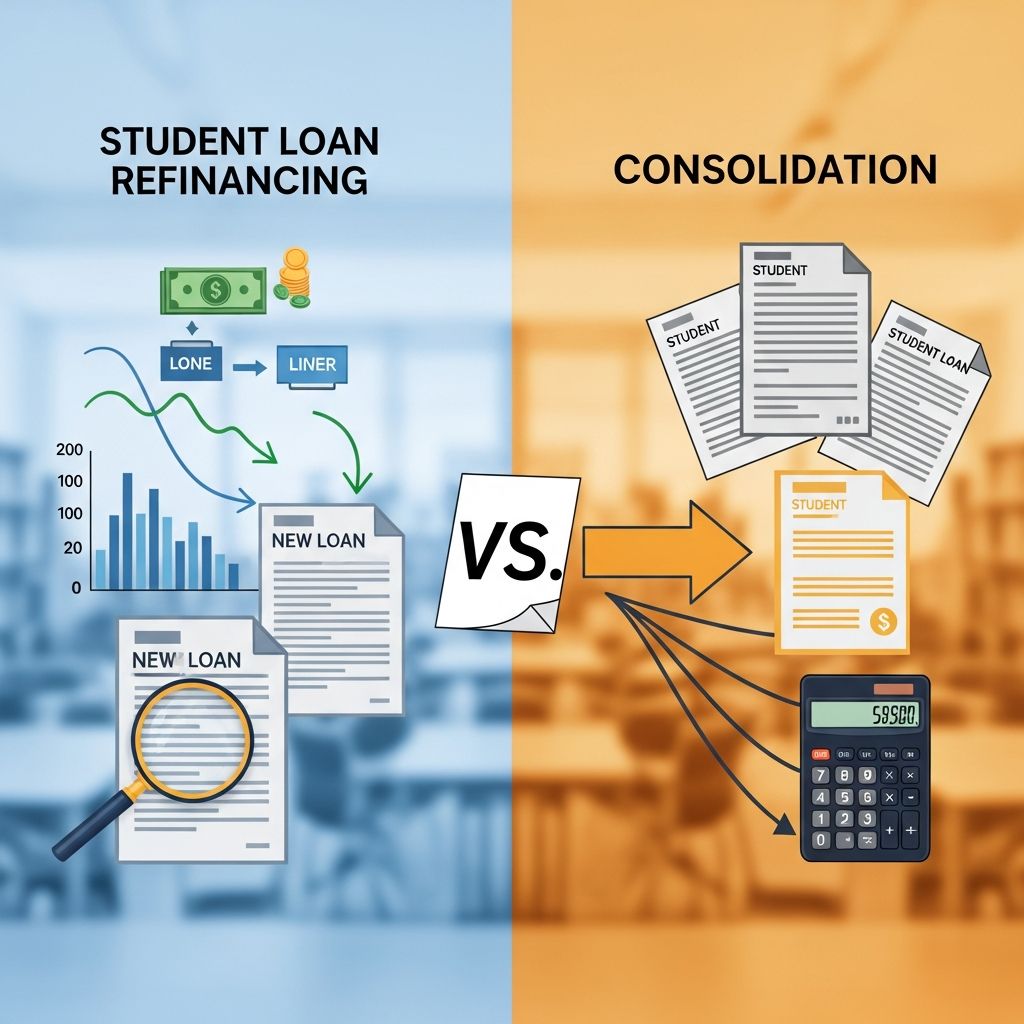

Understand the key differences between student loan refinancing and consolidation to choose the best option for simplifying payments and saving money on your debt.

Student Loan Refinancing vs Consolidation: Which Is Right for You?

Managing multiple student loans can be overwhelming, with varying interest rates, servicers, and repayment terms. Both

student loan refinancing

andconsolidation

offer ways to simplify into one payment, but they differ significantly in costs, benefits, and eligibility. Refinancing typically secures a new loan from a private lender to replace existing ones, often at a lower interest rate based on creditworthiness. Consolidation combines federal loans into a single federal loan with a weighted average rate, preserving government perks but rarely reducing costs.What Is Student Loan Consolidation?

**Student loan consolidation** merges multiple federal loans into one new federal Direct Consolidation Loan through the U.S. Department of Education. This process streamlines payments to a single servicer and monthly bill, without requiring a credit check. The new interest rate is the weighted average of your original loans’ rates, rounded up to the nearest 1/8th of a percent, so it doesn’t lower your overall costs.

Private lenders also offer consolidation for federal or private loans, but this acts like refinancing: you lose federal benefits and get a credit-based rate. Consolidation suits borrowers prioritizing simplicity over savings, especially to qualify for federal programs like income-driven repayment (IDR).

Types of Loans Eligible for Consolidation

- Federal Direct Subsidized and Unsubsidized Loans

- Federal PLUS Loans (parent or graduate)

- Federal Perkins Loans (if not already consolidated)

- FFEL Program Loans (older federal loans)

- Not eligible: Private loans (unless via private lender), defaulted loans without resolution

Not all federal loans qualify, and you can’t consolidate parent PLUS with your own undergrad loans.

Pros and Cons of Consolidation

| Pros | Cons |

|---|---|

| One monthly payment and servicer | No interest rate reduction; weighted average rate |

| Retains federal benefits (IDR, forgiveness, deferment) | Longer terms increase total interest paid |

| No credit check for federal program | Limited to federal loans (federal option) |

| Fixed rate locks in variable loans | Rounded-up rate may slightly increase costs |

Consolidation extended repayment can drop monthly payments but extends the term up to 30 years, potentially costing thousands more in interest.

What Is Student Loan Refinancing?

**Student loan refinancing** replaces existing loans (federal, private, or both) with a new private loan from a lender like a bank or credit union. The goal is a lower interest rate, shorter term, or reduced payments based on your credit score, income, and debt-to-income ratio. Unlike consolidation, it pays off old loans entirely, creating brand-new terms.

Refinancing suits strong-credit borrowers (typically 670+ FICO) seeking savings, but federal loans lose perks like Public Service Loan Forgiveness (PSLF). Cosigners can help qualify or get better rates.

Loans Eligible for Refinancing

- Federal student loans (all types)

- Private student loans

- Both combined into one new loan

- Parent PLUS or grad loans (can transfer ownership)

Minimum loan balances often start at $10,000–$50,000, varying by lender.

Pros and Cons of Refinancing

| Pros | Cons |

|---|---|

| Potentially lower interest rate (credit-based) | Loses federal benefits (IDR, forgiveness) |

| Custom terms: shorter for savings, longer for affordability | Credit check required; poor credit means higher rates |

| One payment; can remove cosigner | No government-backed protections |

| Combines federal + private loans | Hard inquiry may ding credit temporarily |

Refinancing a $50,000 loan at 7% to 4% over 10 years could save over $10,000 in interest. (Calculations based on standard amortization formulas.)

Student Loan Refinancing vs Consolidation: Key Differences

The core distinction: consolidation simplifies federal loans without rate changes or credit pulls, while refinancing optimizes rates via private loans but forfeits protections. Here’s a side-by-side:

| Feature | Consolidation (Federal) | Refinancing (Private) |

|---|---|---|

| Eligible Loans | Federal only | Federal + Private |

| Interest Rate | Weighted average, rounded up | New rate based on credit |

| Federal Benefits | Preserved | Lost |

| Credit Check | No | Yes |

| Cost Savings | Minimal/none | Possible lower rate/payments |

| Repayment Options | IDR, forgiveness | Fixed/variable terms only |

Post-2006 federal loans have fixed rates, so consolidation can’t capture variable-rate savings like pre-2005 loans.

Costs and Savings Comparison

Consolidation rarely saves money: a borrower with loans at 5% and 7% gets ~6% weighted average—no reduction. Longer terms (e.g., 25–30 years) lower payments but inflate total interest.

Refinancing shines for savings: strong-credit grads often drop from 6–8% federal rates to 3–5% private. Example: $30,000 at 6.8% (10 years) costs $42,000 total; refinanced to 4% costs $36,500—a $5,500 save. Use lender calculators for personalized estimates.

- Break-even analysis: Refinance if rate drops enough to offset fees (0–1% origination).

- Consolidation best for payment simplicity, not dollars saved.

When Should You Consolidate Student Loans?

Choose consolidation if:

- You have only federal loans and value IDR (e.g., 10–20% of discretionary income).

- Simplifying servicers/payments is priority over rate cuts.

- Credit is poor or you’re pursuing PSLF/Teacher Loan Forgiveness.

- Variable-rate FFEL loans need fixing.

Avoid if seeking lower rates or have private loans.

When Should You Refinance Student Loans?

Opt for refinancing when:

- Excellent credit (670+ FICO), stable income.

- No plans for federal forgiveness/IDR.

- Mixing federal/private loans or removing cosigner.

- High rates (6%+) could drop 1–3%.

High-earners not needing protections save most. Shop multiple lenders for best rates.

Student Loan Refinancing vs Consolidation Calculator Example

Assume $50,000 debt:

| Scenario | Rate | Term | Monthly Payment | Total Paid |

|---|---|---|---|---|

| Original (avg) | 6.5% | 10 years | $580 | $69,600 |

| Consolidation | 6.625% | 10 years | $585 | $70,200 |

| Refinance | 4.5% | 10 years | $525 | $63,000 |

| Consolidation (extended) | 6.625% | 25 years | $340 | $102,000 |

(Approximate; use official tools for precision.) Refinancing saves $6,600; extended consolidation costs $32,400 more despite lower payments.

Frequently Asked Questions (FAQs)

Can I refinance federal loans?

Yes, but you’ll lose federal benefits like IDR and forgiveness. Ideal for good-credit borrowers not needing them.

Does consolidation lower my interest rate?

No, it’s a weighted average rounded up—no savings, just simplicity.

Can I consolidate private student loans?

Yes, via private lenders, but it functions as refinancing with potential rate changes and lost benefits.

Is refinancing or consolidation better for PSLF?

Consolidation only—refinancing converts to private, disqualifying from PSLF.

How long does consolidation take?

30–90 days via StudentAid.gov; payments pause during process.

Can refinancing remove a cosigner?

Yes, after 24–48 on-time payments, many lenders release them.

References

- Student Loans: Refinancing or Consolidating – Is There a Difference? — Laurel Road. 2023. https://www.laurelroad.com/refinance-student-loans/refinance-or-consolidate-student-loans-is-there-a-difference/

- Student loan refinancing vs. consolidation — Citizens Bank. 2024. https://www.citizensbank.com/learning/student-loan-consolidation-vs-refinancing.aspx

- Difference Between Student Loan Consolidation and Refinancing — ELFI. 2024. https://www.elfi.com/difference-between-student-loan-consolidation-and-refinancing/

- Student Loan Consolidation vs Refinancing — Sallie Mae. 2023. https://www.salliemae.com/blog/student-loan-consolidation-vs-refinancing/

- Student Loan Consolidation vs. Refinancing: What’s the Difference? — Nelnet Bank. 2024. https://www.nelnetbank.com/learning-center/consolidation-vs-refinancing/

- Student Loan Consolidation Myths — NerdWallet. 2024. https://www.nerdwallet.com/student-loans/learn/student-loan-consolidation-myths

Read full bio of Sneha Tete