Roth 401(k) vs. Traditional 401(k): Which Is Right?

Compare Roth 401(k) and traditional 401(k) plans to decide which retirement savings option best fits your tax situation and future goals.

Roth 401(k) vs. Traditional 401(k): Which Is Right for You?

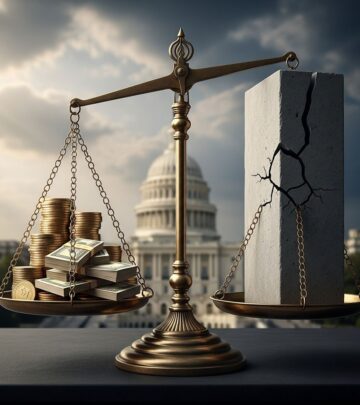

Choosing between a Roth 401(k) and a traditional 401(k) can significantly impact your retirement savings. The primary distinction lies in tax treatment: traditional 401(k) contributions reduce your taxable income now but are taxed upon withdrawal, while Roth 401(k) contributions use after-tax dollars for tax-free qualified withdrawals later.

This decision hinges on your current tax bracket, expected future tax rates, and retirement goals. With 2025-2026 contribution limits at $23,500 (plus $7,500 catch-up for those 50+), understanding these plans helps maximize growth.

What Is a Traditional 401(k)?

A traditional 401(k) allows pre-tax contributions from your paycheck, lowering your current taxable income and providing an immediate tax break. Earnings grow tax-deferred until withdrawal in retirement, when they’re taxed as ordinary income.

Employer matches, if offered, go into a pre-tax account and are taxed later. This plan suits those expecting a lower tax bracket in retirement.

What Is a Roth 401(k)?

A Roth 401(k) uses after-tax contributions, so no upfront tax deduction, but qualified withdrawals—including earnings—are tax-free after age 59½ and a five-year holding period. This offers tax-free growth and no lifetime required minimum distributions (RMDs) as of 2024.

Employer matches still go pre-tax. Ideal for those anticipating higher future taxes or wanting tax diversification.

Roth 401(k) vs. Traditional 401(k): Key Differences

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Contributions | Pre-tax (reduces current AGI) | After-tax (no current deduction) |

| Tax on Withdrawals | Taxed as ordinary income | Tax-free if qualified |

| Employer Match | Pre-tax account | Pre-tax account |

| RMDs | Required at age 73 | None during lifetime (post-2024) |

| 2025-2026 Limit | $23,500 + $7,500 catch-up | Same (combined if both) |

This table highlights core contrasts. You can contribute to both if your plan allows, up to the annual limit.

Pros and Cons of a Traditional 401(k)

Pros

- Immediate tax savings: Lowers current-year taxes, beneficial in high brackets.

- Tax-deferred growth: Compounds without annual taxes.

- Employer match boost: Free money accelerates savings.

- Lower retirement taxes: If in a lower bracket later.

Cons

- Withdrawals taxed, potentially at higher rates.

- RMDs force distributions at 73, triggering taxes.

- Less flexibility for heirs due to taxes.

Pros and Cons of a Roth 401(k)

Pros

- Tax-free withdrawals: Entire balance (qualified) tax-free.

- No RMDs: Keep growing tax-free longer.

- Hedge against tax hikes: Pay taxes now at potentially lower rates.

- Tax diversification: Mix with traditional for flexibility.

Cons

- Higher upfront cost: Reduces take-home pay more.

- No immediate tax break.

- Five-year rule for earnings qualification.

5 Factors to Consider When Choosing

1. Your Current vs. Future Tax Bracket

If you’re in a low bracket now but expect higher later (e.g., career growth), Roth wins. High earners now anticipating drops favor traditional.

2. Time Horizon to Retirement

Younger workers benefit more from Roth’s long tax-free growth. Late starters may prefer traditional’s upfront savings.

3. Employer Match

Matches always pre-tax, so prioritize getting full match regardless.

4. Expected Tax Rates

With potential U.S. tax increases, Roth protects against future hikes. IRS data shows brackets adjust annually.

5. Flexibility and Legacy Planning

Roth offers no RMDs and better inheritance (tax-free for heirs if rules met).

Can You Do Both?

Yes, many plans allow splitting contributions between Roth and traditional, diversifying tax exposure. Combined limit applies. Reallocate yearly as circumstances change.

Contribution Limits and Rules

For 2025-2026: $23,500 under 50; $31,000 age 50+. No income limits for Roth 401(k), unlike Roth IRA. Early withdrawals before 59½ incur 10% penalty plus taxes (pro-rata for Roth).

Who Should Choose a Roth 401(k)?

- Young professionals in low brackets.

- Those expecting higher future taxes/income.

- Seekers of tax-free income in retirement.

- Planners for legacy without tax burdens.

Who Should Choose a Traditional 401(k)?

- High earners needing current deductions.

- Those anticipating lower retirement brackets.

- Preferring immediate cash flow.

Should You Convert Traditional to Roth?

In-plan conversions possible but trigger immediate taxes on pre-tax amounts. Best if expecting higher brackets later. Rollovers to Roth IRA avoid RMDs.

Frequently Asked Questions

What are the 2025-2026 401(k) limits?

$23,500 base + $7,500 catch-up for 50+, combined for both types.

Does Roth 401(k) have RMDs?

No, during owner’s lifetime post-2024.

Can I withdraw Roth 401(k) contributions early?

Contributions yes (tax/penalty-free), earnings no without penalty.

Is employer match Roth or traditional?

Always traditional/pre-tax.

Which is better for most people?

Depends: Roth for growth potential, traditional for current relief. Many experts favor Roth for tax-free future.

Consult a financial advisor for personalized advice. Starting early maximizes either plan’s benefits.

References

- Roth 401(k) vs. 401(k): Comparison and 2025-2026 Limits — NerdWallet. 2025. https://www.nerdwallet.com/retirement/learn/roth-401k-vs-401k

- Roth vs Traditional 401k Calculator — UMCU. 2025. https://www.umcu.org/learn/resources/calculators/traditional-401-k-vs-roth-401-k-calculator

- Roth 401(k) vs. 401(k): Which one is better for you? — Bankrate. 2025. https://www.bankrate.com/retirement/traditional-401k-vs-roth-401k/

- Roth Comparison Chart — Internal Revenue Service. 2025-01-12. https://www.irs.gov/retirement-plans/roth-comparison-chart

- Should You Consider a Roth 401(k)? — Charles Schwab. 2025. https://www.schwab.com/learn/story/should-you-consider-roth-401k

Read full bio of medha deb