Power of the U.S. Dollar: Global Influence and Economic Impact

Explore how the U.S. dollar shapes global markets, trade, and international finance in today's economy.

Understanding the Power of the U.S. Dollar

The U.S. dollar stands as the world’s most influential currency, serving as the backbone of international commerce, finance, and investment. Its dominance stems from decades of economic strength, political stability, and the development of deep, liquid financial markets. The dollar’s role as the primary medium of exchange for global trade, particularly in commodities like oil and natural gas, reinforces its unparalleled position in the global financial system. For most of the last century, the preeminent role of the U.S. dollar in the global economy has been supported by the size and strength of the U.S. economy, its stability and openness to trade and capital flows, and strong property rights and the rule of law.

The structural advantages that have elevated the dollar to its current status remain substantial. The United States offers the world’s deepest and most liquid financial markets, combined with an abundance of extremely safe dollar-denominated assets. This creates persistent demand for dollars from international investors, central banks, and corporations seeking secure places to park capital. When geopolitical uncertainty or financial crises emerge, demand for the dollar typically increases as investors seek refuge in the safest available asset.

The Dollar’s Role in Global Trade

One of the most critical functions of the U.S. dollar is its use as the pricing currency for commodities traded on international markets. Oil, natural gas, agricultural products, and metals are predominantly priced in dollars, which means every country seeking to purchase these essential resources must acquire dollars to do so. This creates a constant, structural demand for the currency that transcends the performance of the U.S. economy alone.

The dollar’s dominance in commodity pricing extends the reach of American economic policy throughout the world. When the Federal Reserve adjusts interest rates or the U.S. government implements fiscal policies, these decisions ripple through global commodity markets and affect economies everywhere. Developing nations and commodity exporters find themselves particularly dependent on dollar dynamics, as fluctuations in the currency’s value directly impact their purchasing power and export revenues.

Recent Shifts in Dollar Strength

The U.S. dollar experienced remarkable appreciation beginning in 2008, gaining approximately 40% in value before beginning to decline at the start of 2025. This recent weakening represents a significant shift in currency markets, marking the dollar’s biggest decline in half a century between March and September 2025. The depreciation reflects multiple converging factors, including trade policy uncertainties, changing global economic dynamics, and reassessment of the dollar’s long-term role.

The value of the dollar tends to increase when the U.S. economy is strong and when global financial crises create safe-haven demand. However, recent conditions have been more complex. Demand for the dollar has weakened due to uncertainty surrounding global trade policies, a slowing U.S. economy, and concerns about increasing U.S. national debt. Morgan Stanley Research estimates the U.S. currency could lose another 10% by the end of 2026, suggesting that the weakening trend may continue despite periodic recoveries.

Impact of Trade Policy on Currency Dynamics

Tariff announcements have significantly accelerated the decline of the U.S. dollar in recent periods. When countries impose tariffs on imports, the dynamics of currency demand shift substantially. A weaker dollar would benefit U.S. exporters, as American goods become cheaper and more competitive overseas. This is particularly advantageous for major multinational corporations like Apple and Microsoft that generate significant earnings from international sales.

The relationship between tariffs and currency value creates complex trade-offs for different segments of the economy. While exporters gain advantages from depreciation, the broader U.S. economy faces headwinds. Import prices become more expensive when the dollar weakens, putting upward pressure on inflation and reducing consumer purchasing power. The U.S. remains a net importer of goods, meaning citizens and businesses ultimately bear higher costs for overseas products.

More isolationist economic stances promoted by recent administrations are pushing global governments to implement decisive policies aimed at improving domestic consumption and reducing reliance on the U.S. economy. This shift represents a fundamental recalibration of global economic relationships, with countries increasingly seeking alternatives to dollar-dependent trade arrangements.

The Emergence of De-Dollarization

One of the most significant challenges to dollar dominance is the accelerating trend toward de-dollarization, wherein countries and corporations increasingly conduct international transactions using non-dollar currencies. When countries trade directly with one another, they are avoiding the burden of doing business in U.S. dollars and utilizing other currencies, partly due to concerns about the dollar’s declining value and unpredictability of U.S. trade policy.

This shift has profound implications for the global economy. Fundamentally, de-dollarization could shift the balance of power among countries, and this could reshape the global economy and markets. The impact would be most acutely felt in the U.S., where de-dollarization would likely lead to broad depreciation and underperformance of U.S. financial assets versus the rest of the world. International corporations may prefer to be paid in currencies other than the dollar due to its declining value as well as uncertain U.S. trade policy.

The Federal Reserve has noted that the dollar’s international usage is little changed over the past 5 years and far exceeds the U.S. share of global GDP and trade. However, several possible challenges to dollar dominance are increasingly discussed among economists and policymakers. The possibility of challenges to the U.S. dollar’s dominance could come from continued rapid growth of China, which is by far the world’s largest exporter.

Currency Strength and Safe-Haven Status

Despite its recent decline in value, the U.S. dollar still maintains its role as a safe-haven currency that investors turn to during times of uncertainty and crisis. Countries with safe-haven currencies share common traits, including political stability, strong and resilient economies, deep and liquid financial markets, and stable inflationary environments. The dollar continues to possess these characteristics compared to most alternative currencies.

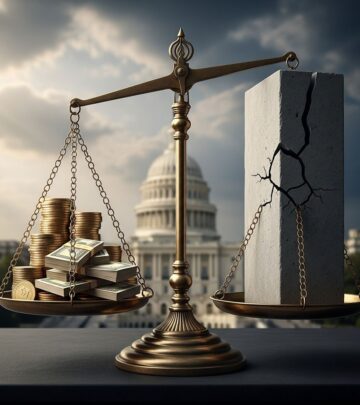

However, the dollar’s safe-haven status faces potential threats if the United States is no longer perceived as a strong global economy and if budget deficits balloon out of control. Recent downgrades to the U.S. credit rating by agencies like Moody’s signal growing concerns about the nation’s fiscal trajectory. These developments raise questions about whether the structural foundations supporting the dollar’s dominance will remain intact.

Investment Implications for Different Stakeholders

A weaker dollar creates both positive and negative impacts for various categories of investors and economic actors. On the positive side, U.S. investors holding foreign assets may see the value of those assets increase when the foreign currency is converted back into dollars. U.S. companies with significant earnings overseas also benefit from a weaker dollar, as their earnings in foreign currency convert into more dollars, boosting revenue margins and profits.

On the negative side, U.S. consumers face higher costs for overseas goods impacted by both tariffs and diminished dollar value. It takes more dollars to buy the same amount of goods overseas. Higher costs can erode returns on fixed income investments and may impact consumer spending. Traveling or investing overseas will also be more expensive for American individuals and businesses.

Additionally, U.S. assets could become less compelling for foreign investors when the dollar weakens, as the expected returns in their home currencies decline. This could reduce inflows of foreign capital into U.S. markets and increase pressure on asset valuations.

The Role of Interest Rates and Economic Convergence

Currency valuations are fundamentally shaped by interest rate differentials and economic growth disparities between nations. David Adams, head of G10 FX Strategy at Morgan Stanley, notes that “the second act for the dollar’s weakening should come over the next 12 months, as U.S. interest rates and growth converge with those of the rest of the world.” When U.S. interest rates are substantially higher than those offered elsewhere, the dollar appreciates as investors seek higher returns. Conversely, when rates converge, the dollar weakens.

The Federal Reserve’s policy decisions therefore have enormous implications for currency markets globally. If the Fed continues to cut rates in 2026 while other major central banks maintain higher rates or cut more slowly, the dollar could face continued downward pressure. These dynamics create a complex interplay between monetary policy, currency markets, and real economic outcomes.

Commodity Markets and Producer Benefits

A weaker dollar has particular implications for commodity-producing nations and industries. When the dollar depreciates, the prices of commodities priced in dollars effectively rise in other currencies, boosting demand and prices for commodities, which benefits U.S. producers. This creates opportunities for American agricultural exporters, energy producers, and mining companies to gain market share and improve profitability.

However, this benefit must be weighed against higher input costs and inflation concerns. Import prices rising due to dollar weakness can increase production costs for manufacturers and raise overall inflation in the economy, creating headwinds for the Federal Reserve’s monetary policy objectives.

Long-Term Outlook for Dollar Dominance

Despite current challenges and recent depreciation, the Federal Reserve remains confident that the dollar will likely remain the world’s dominant international currency for the foreseeable future. This projection is based on the absence of large-scale, lasting disruptions that simultaneously damage the value of the U.S. dollar as a store of value or medium of exchange and bolster the attractiveness of dollar alternatives.

The dollar holds advantages that remain unrivaled in many respects. By offering the ability to invest reliably and profitably across a massive and best-performing opportunity set, the U.S. dollar maintains structural advantages. The primary benefit of a dominant USD on the international stage is that it creates structural demand for dollar-denominated assets, allowing the U.S. government to fund its growing external debt liabilities at relatively favorable rates.

However, economists acknowledge that challenges to the USD’s global role have increased over recent years and have arguably intensified in 2025. The combination of policy uncertainty, shifting trade dynamics, and potential de-dollarization efforts by other nations creates a more complex environment than the dollar has faced in recent decades.

Frequently Asked Questions About the U.S. Dollar

Q: Why is the U.S. dollar considered a safe-haven currency?

A: The U.S. dollar is regarded as a safe-haven currency because the United States offers political stability, a strong and resilient economy, deep and liquid financial markets, and a stable inflationary environment. Investors turn to the dollar during global uncertainty or financial crises because these structural strengths make it a reliable store of value.

Q: How does a weaker dollar affect American consumers?

A: A weaker dollar makes imported goods more expensive for American consumers, as it takes more dollars to purchase the same amount of foreign products. This can increase inflation, reduce consumer purchasing power, and make international travel more costly. It also erodes returns on fixed income investments denominated in dollars.

Q: What benefits do U.S. exporters gain from a weaker dollar?

A: When the dollar weakens, U.S. goods become cheaper and more competitive in international markets. American exporters can sell their products at lower prices while maintaining profit margins, making them more attractive to foreign buyers. This is particularly beneficial for large multinational corporations that generate significant earnings overseas.

Q: What is de-dollarization and why does it matter?

A: De-dollarization refers to the trend of countries and corporations conducting international transactions using non-dollar currencies to avoid dependence on the U.S. dollar. It matters because it could fundamentally shift the balance of power among countries and reshape the global economy, potentially leading to broad depreciation and underperformance of U.S. financial assets.

Q: How do tariffs affect the U.S. dollar’s value?

A: Tariff announcements have accelerated the decline of the U.S. dollar by creating uncertainty about trade policy and reducing the competitiveness of global exporters selling goods into the U.S. This policy uncertainty weakens demand for the dollar as international investors become less confident about future economic conditions.

References

- The U.S. Dollar’s New Role in the Global Economy — Commerce Trust Company. 2025. https://www.commercetrustcompany.com/research-and-insights/articles/the-u.s.-dollars-new-role-in-the-global-economy

- The International Role of the U.S. Dollar – 2025 Edition — Federal Reserve. 2025-07-18. https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-u-s-dollar-2025-edition-20250718.html

- U.S. Dollar: Losing Its Luster? — TIAA. 2025-08. https://www.tiaa.org/public/pdf/cio-focuspoint-us-dollar-losing-its-luster-aug-2025.pdf

- Devaluation of the U.S. Dollar 2025 — Morgan Stanley. 2025. https://www.morganstanley.com/insights/articles/us-dollar-declines

- De-dollarization: The End of Dollar Dominance? — J.P. Morgan. 2025. https://www.jpmorgan.com/insights/global-research/currencies/de-dollarization

Read full bio of medha deb