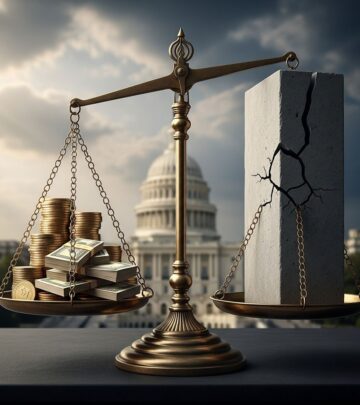

How to Pull Your Small Business Out of a Cash Crunch

Practical strategies to rescue your small business from cash flow shortages and restore financial stability.

Cash crunches strike small businesses unexpectedly, often due to delayed payments, unexpected expenses, or seasonal slowdowns. These situations threaten operations, payroll, and growth, but with targeted strategies, you can stabilize finances quickly and prevent future crises. This guide outlines actionable steps to identify issues, implement fixes, and build resilience.

Vet Clients Carefully

One primary cause of cash shortages is unreliable clients who delay or default on payments. Before signing contracts, perform thorough due diligence to minimize risks.

- Check credit history: Use services like Dun & Bradstreet or Experian Business to review potential clients’ payment records and financial stability.

- Request references: Contact previous vendors or partners to gauge reliability and payment habits.

- Assess financials: For larger deals, request recent financial statements or bank references to confirm liquidity.

- Start small: Begin with pilot projects or smaller orders to test payment behavior before committing to big contracts.

Implementing these checks upfront can filter out high-risk clients, ensuring steadier cash inflows. According to the U.S. Small Business Administration (SBA), poor client selection contributes to 20% of small business failures.

Diversify Your Client Base

Over-reliance on one or two clients amplifies cash flow volatility. If a key account pays late or leaves, revenue plummets.

- Target new industries: Expand into complementary sectors to spread risk—e.g., a marketing firm serving retail could add tech startups.

- Geographic expansion: Use online platforms to reach clients beyond your local area, reducing dependence on regional economies.

- Recurring revenue models: Shift to subscriptions or retainers for predictable income streams.

- Set diversification goals: Aim for no single client exceeding 20-25% of total revenue.

Diversification stabilizes cash flow; Federal Deposit Insurance Corporation (FDIC) data shows businesses with varied clients weather downturns 30% better.

Let a Third Party Handle Client Payments

Chasing payments drains time and resources. Outsourcing collections or using automated invoicing services streamlines receivables.

- Invoice factoring: Sell unpaid invoices to a factor for immediate cash (typically 80-90% of value), recovering the rest minus fees upon client payment.

- Payment processors: Integrate tools like Stripe or PayPal for faster, automated collections with built-in reminders.

- Collection agencies: For overdue accounts, hire specialists who take a percentage (20-50%) of recovered funds.

These methods can shorten payment cycles from 60+ days to under 30, per SBA guidelines.

Negotiate with Vendors and Landlords

Extend your payables without damaging relationships by proactive communication.

- Request extensions: Ask for 30-60 day terms if you have a good history; offer early payments on future orders as incentive.

- Barter services: Trade your expertise for goods—e.g., a web designer offers site updates for office supplies.

- Rent concessions: Propose temporary rent reductions or deferred payments in exchange for a longer lease commitment.

- Bulk discounts: Negotiate better rates for upfront lump-sum payments when cash allows.

Vendor negotiations preserve cash for critical operations; FDIC reports flexible terms aid 40% of distressed firms.

Cut Non-Essential Expenses

Audit spending ruthlessly to free up cash. Focus on high-impact reductions without harming core operations.

| Expense Category | Potential Savings | Action Steps |

|---|---|---|

| Office Supplies/Travel | 20-30% | Switch to digital tools, virtual meetings; buy in bulk. |

| Subscriptions/Services | 15-25% | Cancel unused software, renegotiate contracts. |

| Marketing | 10-20% | Prioritize high-ROI channels like email over paid ads. |

| Utilities/Overhead | 5-15% | Energy audits, remote work policies. |

Track savings monthly; aim to slash 10-20% of overhead. Financial literacy experts recommend expense audits quarterly.

Tap Into Emergency Funds or Lines of Credit

Prepare for crunches with buffers. Businesses with emergency funds survive disruptions 50% longer.

- Build reserves: Save 3-6 months of operating expenses in a high-yield account.

- Business credit lines: Secure revolving credit from banks for short-term needs at lower rates than cards.

- Credit cards wisely: Use for bridges only, paying off quickly to avoid high interest.

The SBA endorses emergency funds as foundational to cash management.

Explore Small Business Loans and Grants

When internal fixes fall short, external funding bridges gaps. Compare options carefully.

| Funding Type | Pros | Cons | Best For |

|---|---|---|---|

| SBA Loans | Low rates, long terms | Slow approval | Established businesses |

| Online Lenders | Fast funding | High fees | Quick cash needs |

| Grants | Free money | Competitive | Nonprofits, innovators |

| Crowdfunding | No repayment | Marketing effort | Product launches |

Select based on needs; FDIC stresses matching funding to repayment capacity. Recent data shows SBA loans averaged 6-8% interest in 2025.

Boost Sales and Revenue Quickly

Proactive revenue generation offsets shortfalls.

- Discounts/Flash sales: Offer 10-20% off for immediate payments.

- Upsell existing clients: Bundle services or introduce add-ons.

- Pre-sales: Secure deposits for future deliverables.

- Partnerships: Co-market with non-competing businesses.

Revenue spikes can resolve crunches in weeks.

Improve Cash Flow Forecasting

Prevention beats cure. Use tools for visibility.

- Software: QuickBooks or Xero for real-time tracking.

- Weekly reviews: Project inflows/outflows 30-90 days ahead.

- Scenario planning: Model best/worst cases.

Accurate forecasting reduces crunch frequency by 25%, per financial experts.

Frequently Asked Questions (FAQs)

Q: How long does it take to recover from a cash crunch?

A: With aggressive action, 1-3 months; full stability may take 6 months with structural changes.

Q: What’s the first step in a cash crisis?

A: Create a 30-day cash flow projection to prioritize essentials.

Q: Are business credit cards a good bridge?

A: Only short-term; high APRs (20%+) compound quickly—pay off ASAP.

Q: How much emergency fund is ideal?

A: 3-6 months of operating expenses, adjusted for industry volatility.

Q: Can grants really help small businesses?

A: Yes, especially for underserved groups; check Grants.gov regularly.

References

- FDIC Consumer Compliance Examination Manual — Federal Deposit Insurance Corporation. 2010-07-01. https://www.fdic.gov/regulations/laws/federal/2010/10c91ad60.pdf

- Your Small Business Needs an Emergency Fund, Too — Wise Bread. Accessed 2026. https://www.wisebread.com/your-small-business-needs-an-emergency-fund-too

- How to Pull Your Small Business Out of a Cash Crunch — Wise Bread. Accessed 2026. https://www.wisebread.com/how-to-pull-your-small-business-out-of-a-cash-crunch

- Financial Literacy Month — FNB Community Bank / Money Management International. Accessed 2026. https://www.fnbmwc.com/about/blog/post.html?title=financial-literacy-month

- 10 Smart Ways to Get a Small Business Loan — Wise Bread. Accessed 2026. https://www.wisebread.com/10-smart-ways-to-get-a-small-business-loan

Read full bio of medha deb