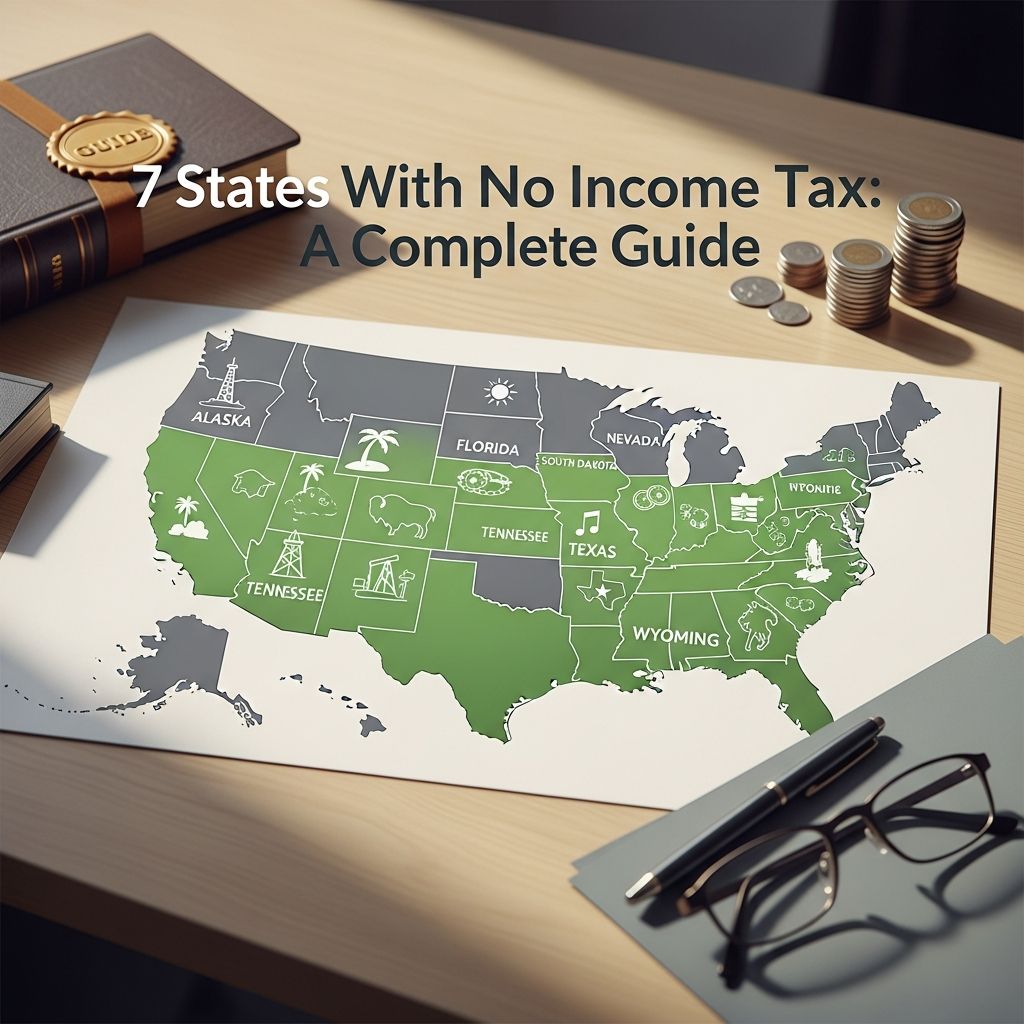

7 States With No Income Tax: A Complete Guide

Explore states without income tax and discover how they impact your finances and relocation decisions.

7 States With No Income Tax: A Complete Financial Guide

When considering where to live or retire, one of the most significant financial factors to evaluate is state income taxation. While most states impose some form of income tax on their residents, seven states have chosen not to levy this burden. Understanding which states offer this tax advantage and how they fund their operations can help you make informed decisions about relocation and financial planning. This comprehensive guide explores the seven states with no income tax, their alternative revenue sources, and the implications for residents.

Understanding State Income Tax

State income tax is a direct tax levied by individual states on the earned income of residents and sometimes non-residents who work within the state. Income taxes represent a significant revenue source for most states, funding education, infrastructure, healthcare, and other public services. However, some states have chosen an alternative approach, relying on different revenue mechanisms to fund their operations.

The decision not to impose state income tax reflects a broader economic philosophy prioritizing lower tax burdens to attract businesses and residents. States without income tax must compensate for this lost revenue through other taxation methods, such as sales taxes, property taxes, and excise taxes.

The Seven States Without Income Tax

Seven states have distinguished themselves by maintaining no state income tax. These states are:

- Alaska — Known for its oil revenues and Permanent Fund Dividend

- Florida — A popular retirement destination with no income tax

- Nevada — Home to Las Vegas and gambling revenue

- South Dakota — A Great Plains state with low taxes

- Tennessee — A southeastern state with diverse economy

- Texas — The largest no-income-tax state by population

- Wyoming — A Mountain West state with unique tax structure

Each of these states has developed unique economic models to operate without income tax, leveraging their specific geographic advantages, natural resources, or tourism industries.

Alaska: Oil Wealth and the Permanent Fund Dividend

Alaska stands out among no-income-tax states due to its substantial oil revenues. The state established the Alaska Permanent Fund in 1976 to manage its oil wealth sustainably. Rather than relying solely on income taxes, Alaska uses petroleum revenues to fund state operations and even distributes a portion to residents through the annual Permanent Fund Dividend (PFD).

Key features of Alaska’s tax structure include:

- No state income tax on wages or investment income

- Oil and gas production revenues fund state operations

- Annual dividend payments to qualified residents (ranging from $1,000 to $2,000 annually)

- Higher property taxes and sales taxes compared to some other states

- Corporate income tax on oil and gas businesses

Alaska’s approach demonstrates how states can leverage natural resources to maintain low income taxes while providing services to residents.

Florida: The Sunshine State’s Tax Appeal

Florida has long been a popular destination for retirees and individuals seeking to minimize their tax burden. With no state income tax, Florida attracts residents from across the nation and generates revenue through alternative means.

Florida’s revenue sources include:

- Sales tax (6% state rate, plus local additions)

- Property taxes (average around 0.75% of home value)

- Tourism-related taxes and hospitality fees

- Corporate taxes and business licensing fees

- Excise taxes on specific products

For retirees, Florida’s lack of income tax provides significant financial benefits, particularly for those with investment income or pension distributions. However, residents should consider the relatively high sales tax and property tax implications when evaluating overall tax burdens.

Nevada: Gaming Revenue and Economic Diversification

Nevada’s famous gambling industry has historically provided substantial revenue, allowing the state to forego income taxes. Las Vegas and Reno have transformed Nevada into a tourism and entertainment hub, generating significant tax revenues from casinos, hotels, and related businesses.

Nevada’s tax characteristics include:

- No state income tax

- Gaming taxes and licensing fees (major revenue source)

- Sales tax (7.375% state rate)

- Property taxes (among the lowest in the nation)

- Business licensing and corporate fees

Nevada’s gaming industry provides a unique revenue stream that distinguishes it from other no-income-tax states. However, the state is working to diversify its economy beyond gaming to ensure long-term financial stability.

South Dakota: Agricultural Heritage and Low Taxes

South Dakota combines its agricultural heritage with a modern business-friendly tax environment to maintain its no-income-tax policy. The state has developed a reputation for corporate-friendly regulations and low taxation.

South Dakota’s tax structure features:

- No state income tax on personal wages

- No capital gains tax on long-term investments

- Sales tax (4.5% state rate, with local additions)

- Property taxes (moderate rates)

- Business and agricultural support incentives

South Dakota’s approach attracts business owners, investors, and agricultural enterprises seeking tax-efficient operations. The state’s combination of low taxes and reasonable cost of living appeals to entrepreneurs and retirees alike.

Tennessee: Southern Charm Without Income Tax

Tennessee offers southern hospitality combined with favorable tax treatment. While Tennessee technically had a tax on investment income (Hall Income Tax) until 2021, the state has moved toward complete elimination of income taxation.

Tennessee’s tax environment includes:

- No state income tax on wages (eliminated in phases)

- Elimination of Hall Income Tax on investment income (completed in 2021)

- Sales tax (7% state rate)

- Property taxes (among the lowest in the nation)

- Excise taxes and tourism-related revenues

Tennessee’s transition to complete tax-free status demonstrates states’ willingness to modify tax policies to remain competitive for residents and businesses.

Texas: The Lone Star State’s No-Income-Tax Model

Texas, the second-most populous state and the largest no-income-tax state by population, has built its economic model around low taxation and business growth. The state’s “no state income tax” policy has attracted numerous corporations and individuals seeking tax advantages.

Texas’s tax structure includes:

- No state income tax

- Sales tax (6.25% state rate, with local additions)

- Property taxes (higher than some states but offset by no income tax)

- Business franchise tax (limited tax on business activities)

- Excise taxes and licensing fees

Texas’s approach has contributed to its economic growth and attracted major corporations. However, residents should note that while Texas lacks income tax, property taxes can be substantial in many areas.

Wyoming: Mountain West Tax Benefits

Wyoming offers a unique combination of low taxation, natural beauty, and outdoor recreation. The state’s business-friendly environment and lack of income tax make it attractive for entrepreneurs and individuals seeking tax efficiency.

Wyoming’s tax characteristics include:

- No state income tax

- No corporate income tax

- Sales tax (4% state rate)

- Property taxes (low to moderate rates)

- Mineral extraction taxes (oil and natural gas)

Wyoming’s complete lack of corporate income tax, combined with personal income tax exemption, makes it particularly attractive for business owners and entrepreneurs. The state’s natural resource revenues provide significant funding for operations.

Alternative Revenue Sources for No-Income-Tax States

States without income tax must compensate for lost revenue through various mechanisms:

Sales Taxes

Most no-income-tax states rely heavily on sales taxes, which vary by state and can include local additions. Sales taxes fund state operations by collecting revenue from consumer purchases.

Property Taxes

Property taxes provide another significant revenue source, though rates vary considerably among no-income-tax states. Some states maintain relatively low property taxes, while others rely more heavily on this revenue stream.

Natural Resource Revenues

States like Alaska, Wyoming, and Texas benefit from oil, gas, and mineral extraction revenues. These natural resource taxes provide substantial funding for state operations.

Gaming and Tourism Taxes

Nevada’s gaming industry and tourism-related taxes generate significant revenue. Other states also benefit from tourism-related taxes and hospitality fees.

Business Licensing and Corporate Fees

All no-income-tax states collect revenue through business licensing, corporate fees, and other business-related taxation.

Comparing Overall Tax Burdens

While these states offer no income tax, residents should evaluate their complete tax burden when considering relocation. A state without income tax may have higher sales taxes, property taxes, or both. The overall tax burden depends on individual circumstances, including income source, consumption patterns, and property ownership.

For example, a retiree living on investment income in Florida may pay no state income tax but could face higher property taxes. Conversely, a business owner in Texas might benefit significantly from the combined savings of no income tax and no corporate income tax, despite higher property taxes.

Considerations for Relocation and Financial Planning

When evaluating no-income-tax states for relocation or financial planning purposes, consider these factors:

- Total tax burden: Calculate your complete state and local tax obligations, not just income tax

- Income source: Determine whether your income consists primarily of wages, investment income, or business profits

- Housing market: Evaluate property values, property taxes, and housing costs in your target state

- Cost of living: Consider overall living expenses beyond taxes, including healthcare, utilities, and transportation

- Employment opportunities: Research job markets and economic conditions relevant to your profession

- Residency requirements: Understand how long you must reside in a state to establish residency for tax purposes

- Retirement benefits: Some states offer tax advantages for retirement income, pension distributions, or social security benefits

How No-Income-Tax States Impact Retirement Planning

For retirees, no-income-tax states offer particular appeal. Many retirees receive income from pensions, Social Security, 401(k) distributions, and investment portfolios. States without income tax can significantly reduce the tax burden on these income sources.

However, retirees should carefully evaluate property taxes and other costs, as some no-income-tax states compensate through higher property taxation. Additionally, some states offer preferential tax treatment for specific retirement income sources, such as pensions or Social Security, which may provide similar or better benefits than complete income tax elimination.

Economic Impact of No-Income-Tax Policies

The choice to eliminate income tax reflects broader state economic strategies. These policies can:

- Attract high-net-worth individuals and retirees

- Draw businesses and corporate headquarters

- Encourage entrepreneurship and business formation

- Increase population growth and economic activity

- Generate revenue through higher consumption and business activity

However, critics argue that relying on alternative tax sources can result in higher tax burdens for certain populations and may create revenue instability dependent on natural resources, tourism, or consumption patterns.

Federal Tax Implications

While these states offer no state income tax, residents remain subject to federal income tax. The elimination of state income tax does not reduce federal tax obligations. When planning relocations or investments, consider both state and federal tax consequences to optimize your overall tax position.

Frequently Asked Questions (FAQs)

Q: Do I have to be a permanent resident of a no-income-tax state to benefit from its tax advantages?

A: Most states require you to establish residency, which typically involves living in the state for a certain period and establishing ties such as a permanent home, driver’s license, and voter registration. The specific requirements vary by state, but generally, you must spend the majority of the year in the state to claim residency for tax purposes.

Q: Are there any income sources that are taxed in no-income-tax states?

A: While these seven states don’t tax personal income, some may tax specific business activities, corporate profits, or capital gains in limited circumstances. Additionally, all states are subject to federal income tax requirements. Review your specific situation with a tax professional.

Q: Which no-income-tax state has the lowest overall tax burden?

A: This depends entirely on individual circumstances. Wyoming and South Dakota offer particularly low overall tax burdens, but the best choice depends on your specific income sources, property ownership plans, and consumption patterns. Consult a tax advisor for personalized guidance.

Q: Can I reduce my federal taxes by moving to a no-income-tax state?

A: No, moving to a no-income-tax state does not reduce your federal tax obligations. Federal income tax is separate from state income tax. However, state tax savings can free up resources for other financial goals.

Q: Do no-income-tax states still collect property taxes?

A: Yes, all no-income-tax states collect property taxes, though rates vary significantly. Some states maintain low property taxes, while others rely more heavily on this revenue source. Research your specific state and municipality before relocating.

References

- State Income Tax Rates and Brackets for 2024 — Tax Foundation. 2024. https://taxfoundation.org/data/all/state/state-income-tax-rates-2024/

- Alaska Permanent Fund Dividend Overview — Alaska Department of Revenue. 2024. https://pfd.alaska.gov/

- State and Local Tax Burden Statistics — Tax Foundation. 2024. https://taxfoundation.org/publications/state-local-tax-burden/

- Property Tax Rates by State — National Conference of State Legislatures. 2024. https://www.ncsl.org/research/fiscal-policy/property-tax-overview

- State Sales Tax Rates 2024 — Tax Foundation. 2024. https://taxfoundation.org/data/all/state/sales-tax-rates-by-state-2024/

- Revenue Options for States Without Income Tax — The Pew Charitable Trusts. 2023. https://www.pewtrusts.org/en/research-and-analysis/articles/2023/02/revenue-options-for-states

Read full bio of medha deb